Oil & Gas

Cracking the Hydrocarbon Value Chain: Delivering Sustainable Operational Excellence in the Global Oil & Gas Industry

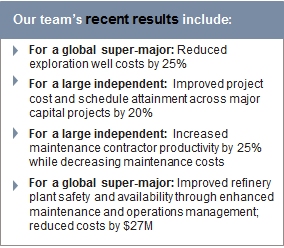

International oil and gas firms face a myriad of complex, resource-driven challenges and opportunities, from regulatory shifts and technological advancements to margin erosion and staffing shortages. The Highland Group partners with international oil companies (IOCs), national oil companies (NOCs), majors, independents and associated private equity houses to achieve and sustain operational excellence amidst these rapidly changing market conditions.

OUR PERSPECTIVE

In Upstream exploration and production, the most common challenges we see are persistent inflation in capital project execution, new basins opening in new geographies and the need to operate existing infrastructure beyond its planned useable life. Political and health, safety and environmental (HSSE) challenges also continue to morph and grow. On the bright side, new technologies such as the use of fully automated drill rigs or gravity gradiometry for early-phase seismic acquisition have eased some segment pressures. However, the sheer number of geographical plays has prompted several majors to adopt new asset strategies “book-ending” production with Downstream plays focused on liquefied natural gas or refining, effectively hedging margin. Meanwhile, the human factor remains a key challenge as the retirement of the sector’s most experienced employees painfully coincides with its need to develop new and difficult sites. Coupled with the impact of unconventional resources, the Upstream segment is facing a formidable level of change while seeking to control the cost of the marginal barrel and become more operationally efficient.

In Midstream, trading follows the macroeconomic environment with predictable price ranges interspersed with extreme volatility. Basel 3 and other national financial regulatory regimes represent a troubling trend toward heavier regulation. Shale and liquefied natural gas effects are pervasive, including nascent gas-on-gas indexation, increasing liquidity and downstream impact on thermal coal and CO2 pricing. More challenging is the move in some majors to rebalance the trading function as the “pivot” between Upstream production and Downstream refining and supply. This shift and the increasing sophistication of ETRM technology are increasing the polarity of success: significantly rewarding those with speed and agility, and significantly punishing those without.

In Downstream, the world continues to move toward hubs around refining and bulk petrochemical manufacturing. U.S. shale hydrocarbons have reinforced this trend with cheap feedstocks driving a burgeoning renaissance along the Gulf Coast. Those without the competitive advantage of cheap feedstocks remain focused on improving margins through tight cost control and efficiency management. In retail, new technologies are dramatically improving customer targeting and increasing “share of wallet” with global brand tie-ins and positioning aligned with smarter real-time distribution capabilities. The challenge remains to boost customer visits and revenue per visit while ruthlessly focusing on cost control and product management.

OUR PRACTICE

While the aforementioned challenges and opportunities are global, the operational consequences and demand for employee behavioral change are local. That’s why The Highland Group’s Oil & Gas consulting practice is led by our global team of experts and supported by local domain consulting teams. Our senior leadership team members have recently worked with all of the super-majors, many of the largest NOCs, numerous independents and several associated private equity houses. With dedicated practice hubs in London, Calgary, Houston, Mexico City, Rio de Janeiro, Abu Dhabi, Luanda and Cape Town, we help our clients respond to the escalating challenges in the Oil & Gas sector, anticipate impending challenges and maximize the value generated from their businesses.

Oil & Gas executives choose The Highland Group as their partner in delivering sustainable operational excellence because we:

- Operate a global team ready to deploy anywhere in the world

- Offer complete focus and clarity in targeting our clients’ business Driver Goals

- Employ a robust, hands-on approach that leverages only senior consultants who have front-line, domain expertise and credibility within the Oil & Gas sector

- Deliver significant, measurable results via our proven, proprietary project methodology

- Ensure sustainable change by delivering operational insight to client senior management while engaging employees and contractors at the field-operations level

Our practice spans the entire hydrocarbon value chain: Upstream, Midstream and Downstream, as well as private equity and other sector M&A transactions.

In Upstream, our experience includes onshore and deepwater conventional plays as well as unconventional shale and oil sands operations. We have also supported many Upstream transactions from a buy-side and a sell-side perspective, serving both oil companies and private equity houses. Recent team experience includes:

- For a global super-major: Designed, piloted and rolled out collaborative environments to support changes in working practices between onshore and offshore organizations in the North Sea, delivering a 4% increase in oil production

- For a large independent: Reconfigured offshore operational processes using decision support environments to embed organizational changes

- For a large NOC: Developed of a set of key performance indicators (KPIs) covering all operations and support functions, and benchmarked those KPIs against comparable organizations

- For a large independent: Established a capital projects value-assurance review process and improved the stage-gate process

- For an IOC: Reconfigured maintenance management processes and systems to reduce consumable and spare-part inventory

- For a global super-major: Developed a new academy paradigm to support deployment of its digital oilfield technology portfolio to its global capital projects portfolio

- For a global IOC: Led the development of a technology strategy and roadmap for the well engineering and capital projects functions, including remote monitoring, well integrity, integrated planning, capital project reporting, estimating and portfolio tracking

- For a large Middle Eastern NOC: Led project to prioritize more than US$10B of capital project investments and more than US$100M in IT capital investments

- For a global super-major: Developed strategy and associated implementation plan to improve the efficiency of its finance function by utilizing a shared services/Center of Expertise model; delivered 30% cost reduction

In Midstream, our experience has focused on logistics (barge, rail and pipes) as well as trading and portfolio optimization. Recent team experience includes:

- For the shipping division of a global super-major: Developed operational standards for the division’s new role within the wider group

- For a global IOC’s midstream trading organization and portfolio: Led organizational and process redesign, ETRM systems portfolio selection and early delivery of a multi-year business transformation program

- For the shipping division of a global super-major: Led business-change program supporting a major midstream transformation program

In Downstream, our experience includes optimization programs for refining and petrochemicals, including supply chain and logistics, margin optimization, asset management, organizational design and safety. Our experience in wholesale and retail operations includes network optimization, supply chain and pricing. Additionally, we have supported many Downstream transactions from a buy-side and a sell-side perspective, serving both oil companies and private equity houses. Recent team experience includes:

- For the North American refining operations of a global super-major: Designed and implemented an integrated maintenance work management process that delivered a plant-wide integrated schedule for increased efficiency and decreased cost

- For an African NOC: Delivered technical due diligence and carve-out strategy for a new refining and petrochemicals joint venture company in China

- For a European NOC: Delivered technical due diligence and integration strategy for a refinery and retail network acquisition in Europe

- For a global super-major: Delivered new global information management service paradigm, including outcome-based scorecards, best practice processes and KPI definition

- For the South African retail operations of a super-major: Delivered significantly increased revenues through realigned, major non-fuel income (NFI) components generated through its retail network of petrol stations

Our uncommon level of expertise and results span the entire hydrocarbon value chain. We pride ourselves on delivering sustainable operational excellence through our goal-driven, hands-on approach.